Ecommerce Returns: Who’s at Fault?

Ecommerce returns are still one of the most prevalent challenges for retailers.

In fact, one could argue that the returns challenge is expanding, particularly for Shopify merchants.

With an average return rate between 15% and 30% in ecommerce, returns of products purchased online negated $41 billion of sales revenue in 2019.

Additionally, Less than half of returned products can be resold at full value. As a result, approximately 5 billion tons of returned products end up in landfills each year.

Still, returns are a natural and healthy part of the ecommerce shopper experience. Up to 40% of your shoppers will return a product by their 3rd purchase. And as many as 67% of shoppers check a brand’s return page before making a purchase. So, your return policies and processes can make or break your customer experience.

Inevitably, the question arises in some form: “Whose fault are returns?”

The Customer Behavior Story

Often, we fall victim to citing blatant patterns of customer behavior, such as wardrobing or fitting room purchases, as the driving factor of returns.

Wardrobing

Wardrobing refers to cases in which a shopper purchases a product (often an expensive outfit) for a particular occasion or event. Essentially renting the item, the customer exploits the return policy by buying and using a product they had no intention of keeping.

While this type of return fraud does occur, there has not been a robust way to identify and track their occurrence.

Without implementing a sophisticated tagging system or examining returned products for signs of prolonged use, merchants can’t be sure whether or not a shopper has committed wardrobing fraud.

Fitting Room Purchases

Fitting room purchases, or bracketing, occurs when a shopper purchases multiple variants of a given item, intending to keep those they want and return the rest.

In these cases, the shopper uses their home in place of an in-store fitting room.

Fitting room purchases are much easier to identify – you can simply look for orders that contain multiple variants of the same product.

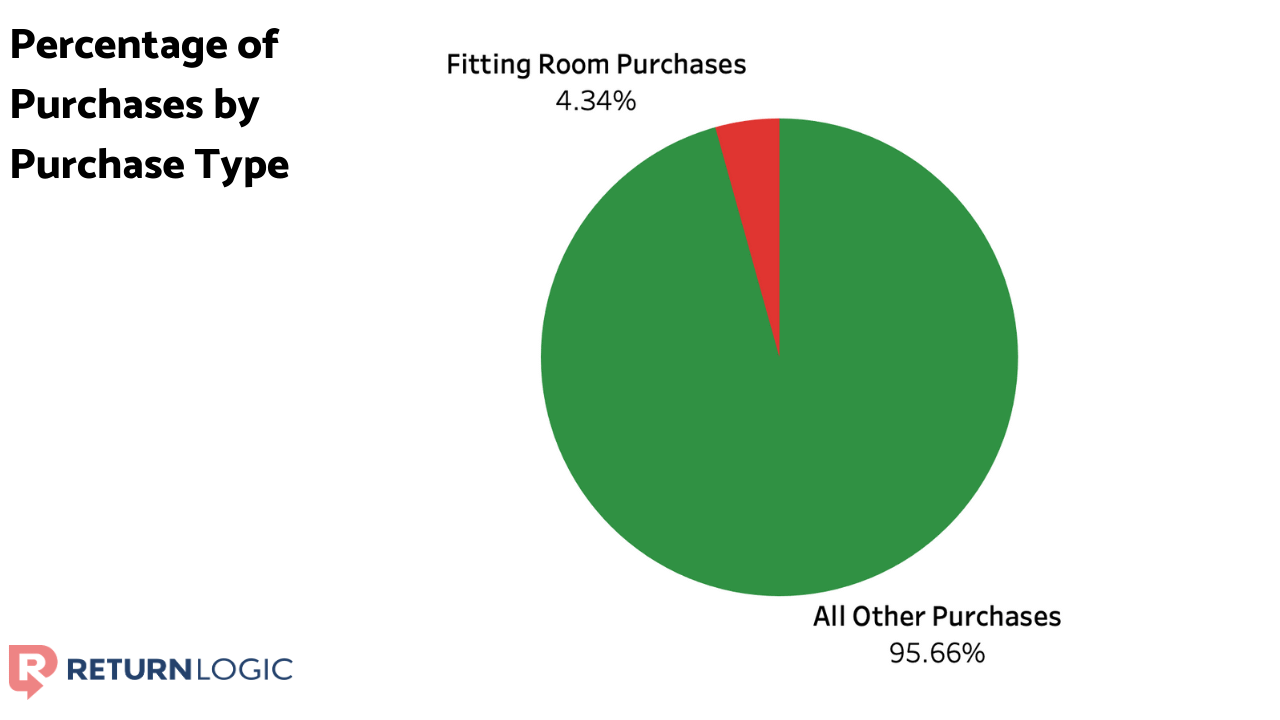

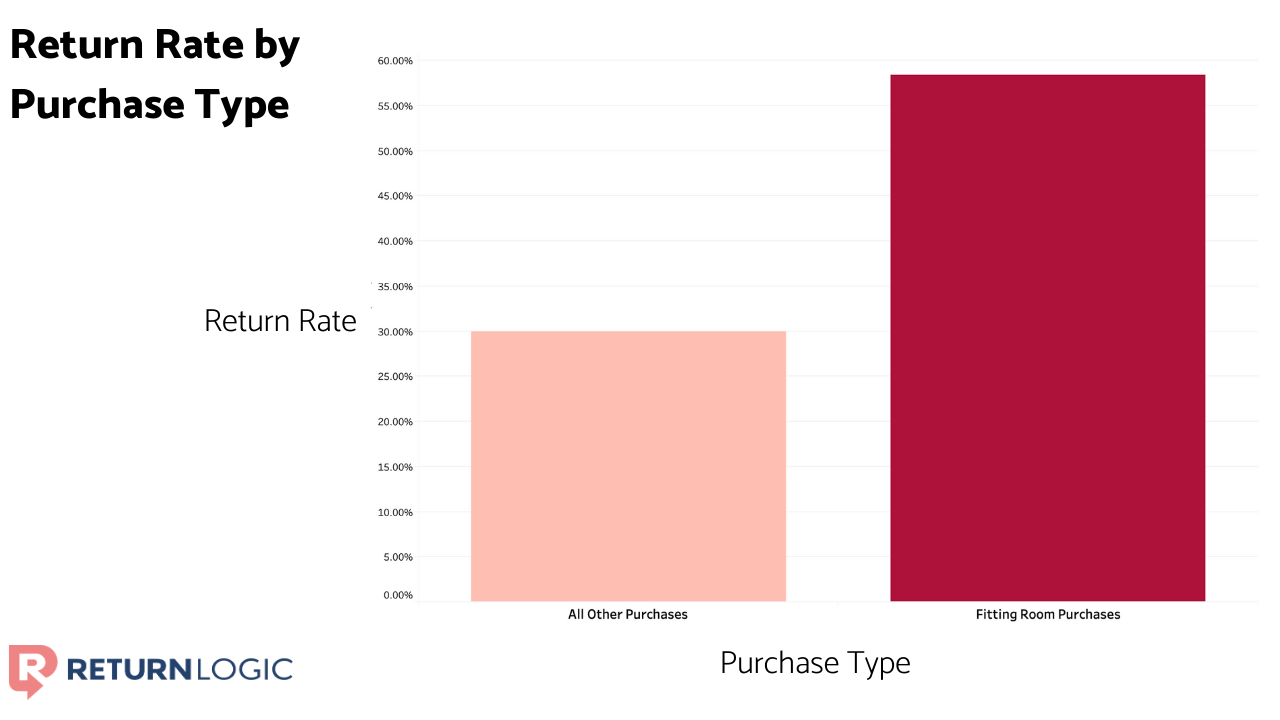

These purchases, however, don’t seem to contribute a sizable percentage of orders for most retailers.

For one retailer we partner with, multi-size purchases have made up only 4.34% of their total orders since 2019.

Although they have an astronomical return rate of 58.43%, fitting room purchases have contributed less than 20% of the total units returned in this time.

As a result, even if all of the fitting room purchases for this retailer changed to single-variant purchases, the overall return rate would move less than 3% – assuming their typical return rate.

So, while fitting room purchases in many cases guarantee that more products will get returned, they usually account for a small proportion of total orders.

The main objective for fitting room purchases should be identifying why shoppers feel the need to try multiple variants and addressing those concerns.

The Return Data Story

Some believe patterns of serial returning are the driving forces of returns in ecommerce. But their impact can be deceptive. They most likely comprise the minority of returns.

The bulk of returns doesn’t result from fraudulent or problematic behavior on the part of the customer.

Through return data, we can dig into the root causes of returns. We’ll see that the return reasons that imply fault – of the retailer, the shopper, the 3PL, or another partner – are least prominent.

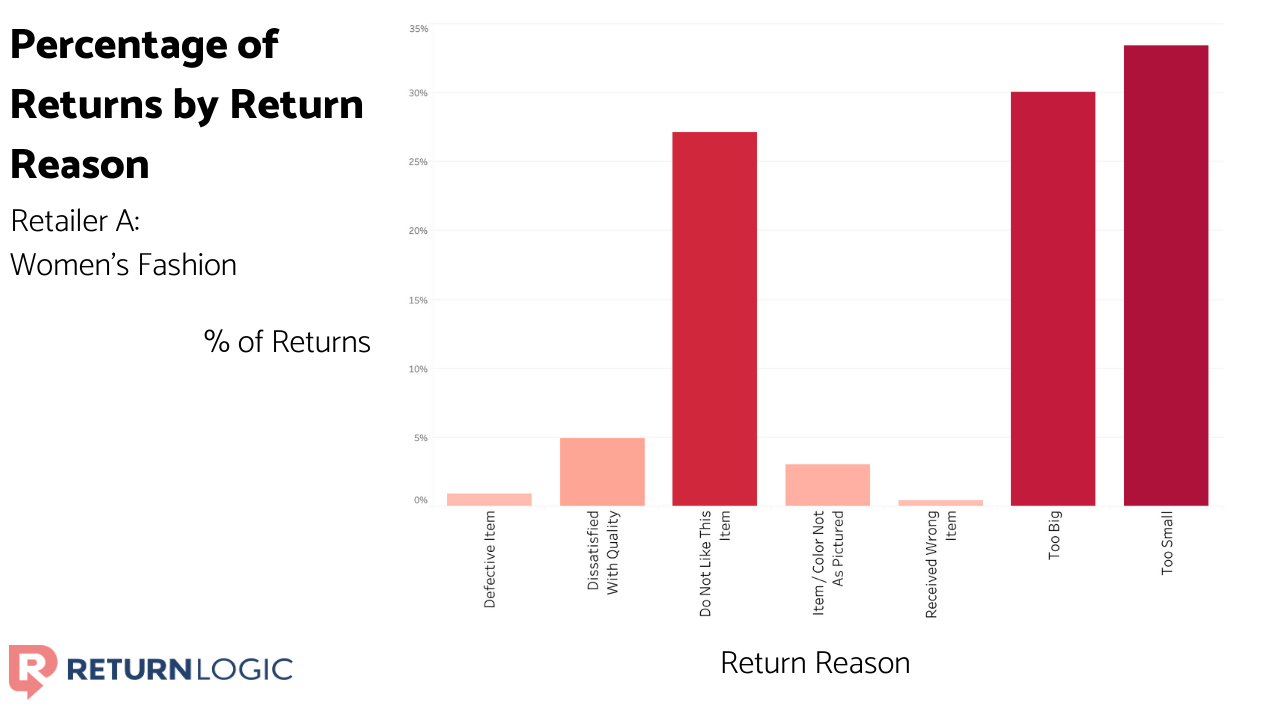

Retailer A

Let’s start by breaking down the return reasons for a women’s fashion brand.

In fashion/apparel, sizing is often the most prominent reason for returns.

The return reasons “Too Big” and “Too Small” make up more than 60% of the units returned when combined.

While shoppers may not engage with product sizing details as much as they should, we can’t blame them for these cases.

It may not be anyone’s fault. It can be hard to purchase products online, especially pants, dresses, or formalwear – all of which require a precise and comfortable fit.

The reason “Don’t Like This Item” is less definitive.

For this case, a deep-dive into return comments may prove to be the most effective.

You can use return data to uncover insights that allow you to adjust products or product information.

Retailer B

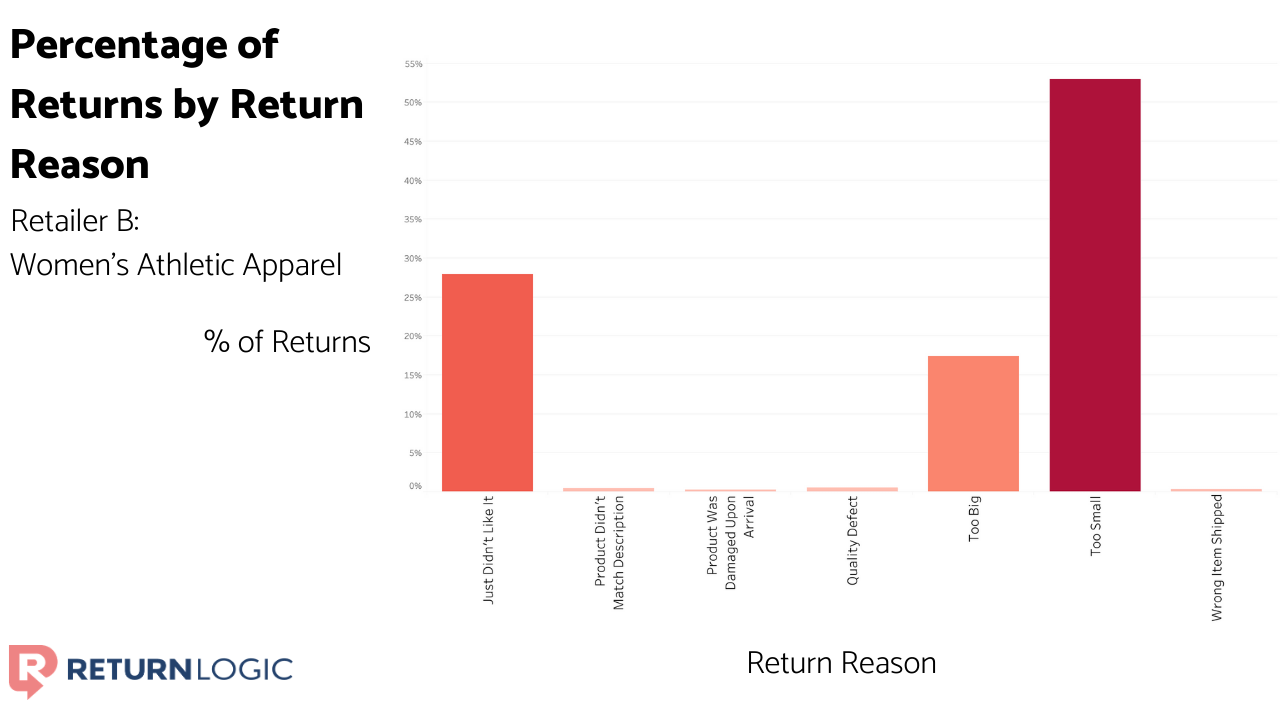

Next, we’ll check out the return reasons for a retailer specializing in women’s fitness apparel.

We see again that sizing is a driving reason for this merchant’s returns. Particularly, “Too Small” has accounted for over 50% of their total returns volume.

Fitness apparel often fits on the tighter side. So, what can the retailer do? Social proof like user-generated photos, videos, and reviews could help create a more realistic product description.

On top of that, it may be helpful to include a guide comparing their sizes to the sizes of brands that shoppers are likely to know.

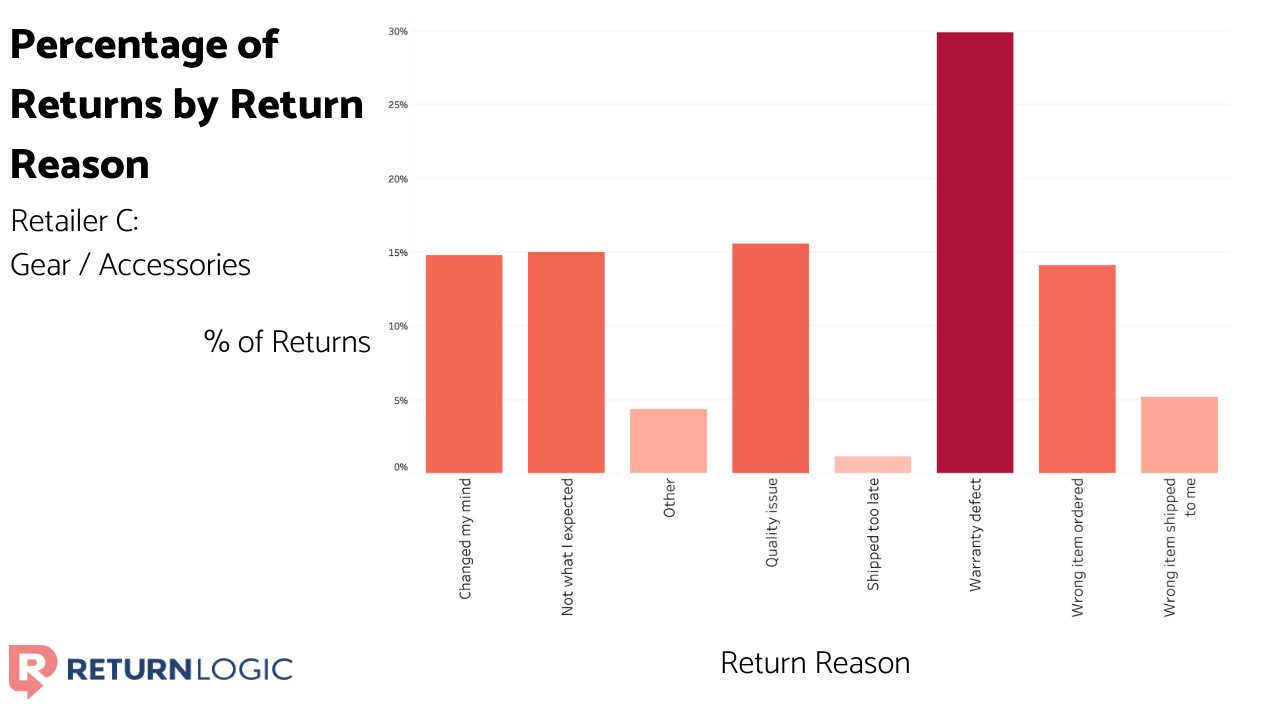

Retailer C

Now, let’s look at the breakdown of return reasons for a brand that sells phone cases and other accessories.

This case is more nuanced because phone cases and accessories are substantially different from apparel.

In this product category, quality and defects are most often the driving factors of returns.

Leveraging return comments may be the most beneficial option in this case as well. They may highlight particular issues that shoppers are experiencing, which could connect back to suppliers, materials, or manufacturing techniques.

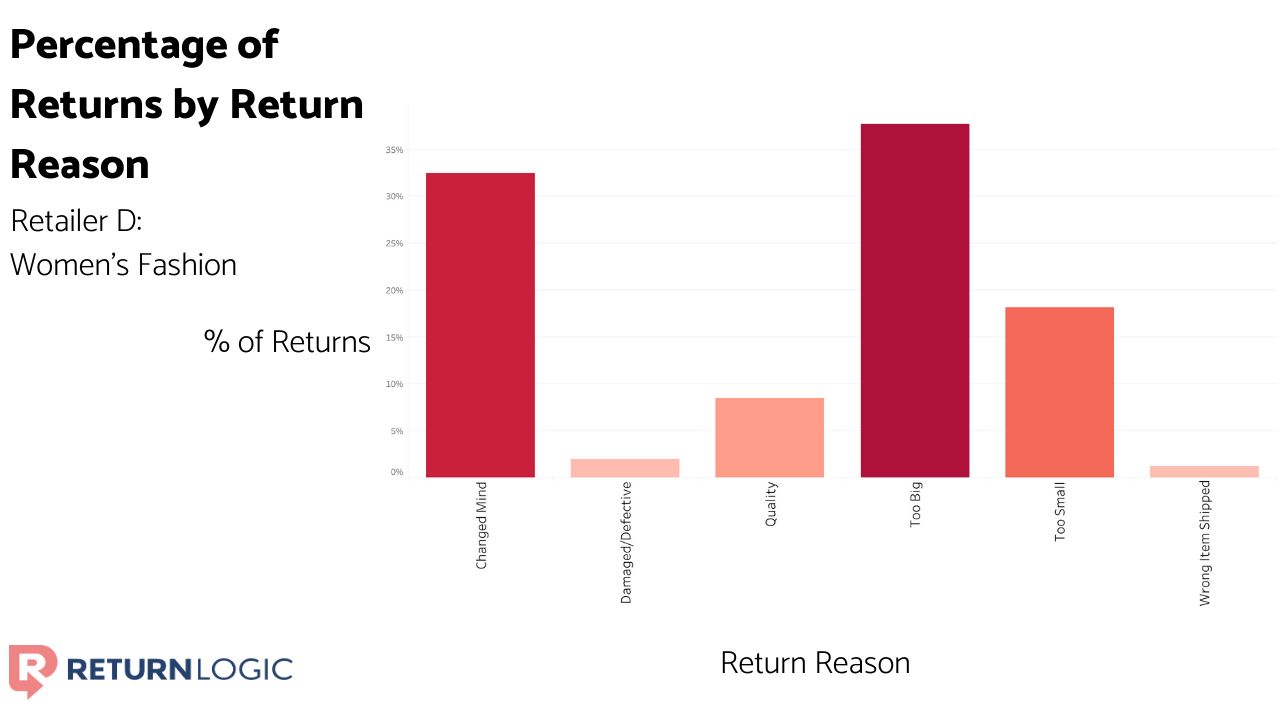

Retailer D

Lastly, we’ll examine the return reasons for a brand that focuses on women’s fashion essentials.

Like the other women’s fashion brand, Retailer A, sizing is the most prominent reason for returns for Retailer B.

However, unlike Retailer A, “Too Big” far exceeds “Too Small” for Retailer B.

This information suggests there could be a systematic issue with production or presentation that’s leading to these returns.

“Changed Mind” is the second most common return reason cited for this retailer, which indicates that impulse or unconfident purchases may be a significant contributing factor to their returns volume.

To Conclude: Ecommerce Return Data Matters

Blatant patterns of serial returns, such as wardrobing or fitting room purchases, don’t seem to cause most returns. And return reasons that indicate fault – quality, defect, damage, or wrong item sent – don’t make up a sizable volume of returns for many retailers either.

But it’s important to remember that who is right doesn’t matter nearly as much as what is right.

Return data empowers retailers to investigate the root causes behind returns and address issues before they spread. By doing so, you can reduce your return rate, drive exchanges over refunds, and ultimately create value for your shoppers. In return, they will create value for you.