Shopify Customer Lifetime Value (CLV) Free Calculator

Shopify Customer Lifetime Value Calculator (CLV)

In this post, we’ll cover one of the most important KPIs Shopify retailers should consider when assessing their store’s financial health and overall growth, customer lifetime value (CLV). By the end of this article, you will be able to accurately calculate your store’s CLV by using our free, easy-to-use calculator built specifically for Shopify merchants.

In a rush? Click here to learn how to calculate CLV for your Shopify store

Introduction to CLV

Customer lifetime value is a metric that estimates the total monetary value that an average customer will contribute to a company over the customer’s expected lifetime. CLV is conceptualized as the sum of all the transactions, including purchases, returns, shipping costs, etc. for an individual.

Why is CLV Important?

CLV is an incredibly useful metric with applications in customer acquisition, customer segmentation, and forecasting revenue. CLV is an indicator of the current and future health of a business.

But customer lifetime value is not a static or deterministic metric. CLV is directly influenced by the experiences and touchpoints you create throughout the customer journey.

Benchmark for Customer Acquisition Cost

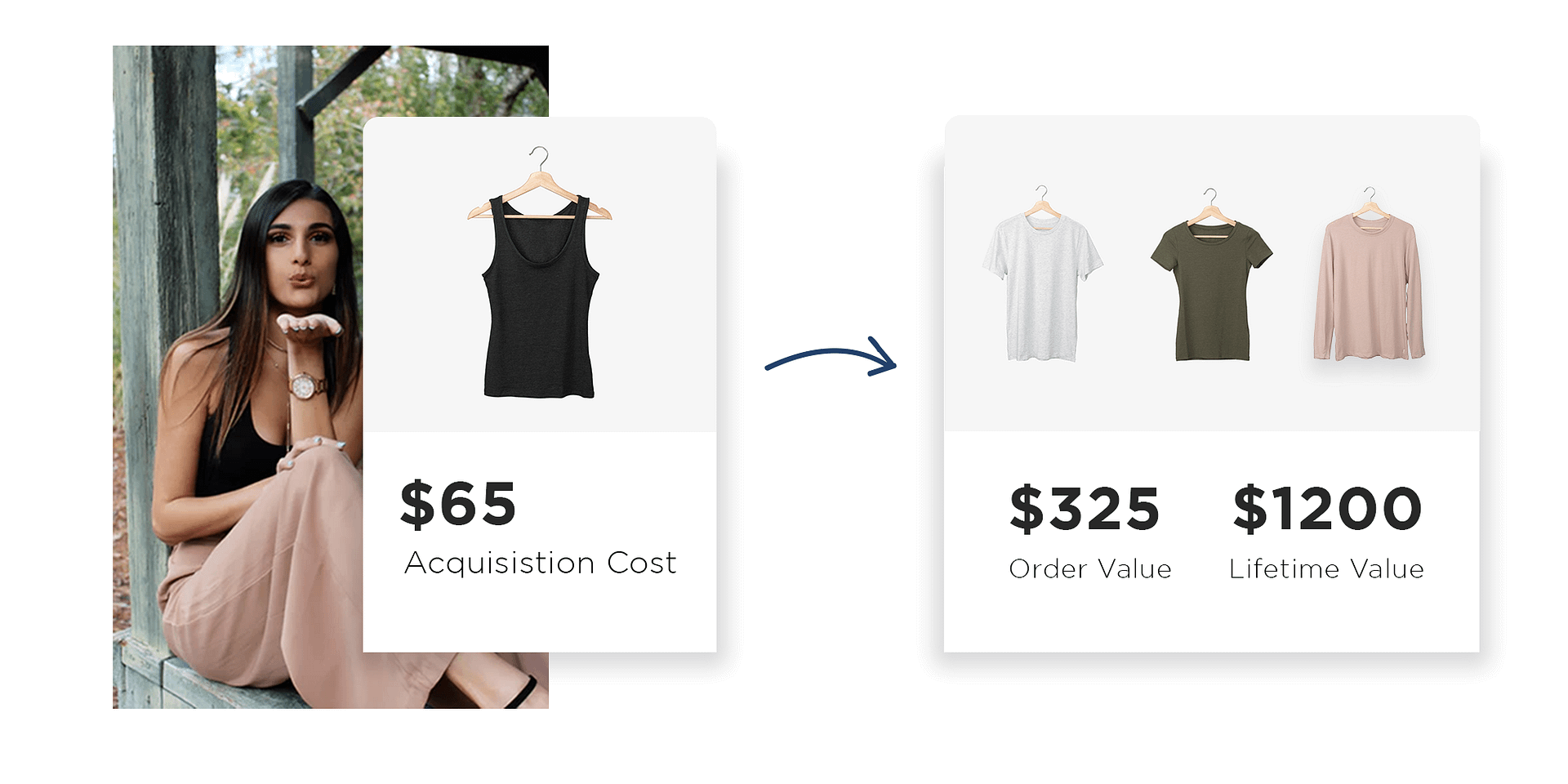

Customer lifetime value is a significant benchmark for a retailer’s customer acquisition cost (CAC), which is the amount spent to acquire new customers divided by the number of customers acquired. By comparing their customer lifetime value to their acquisition costs, retailers can determine the sustainability of their margins, as well as how fast they can scale their businesses.

Effective for Segmentation

CLV can further allow companies to quantify the value associated with individual customers. This empowers them to further group customers by their expected lifetime value and purchase patterns. With this information, companies can more intelligently manage customer relationships.

Thanks to unique data gathered at ReturnLogic, we’re able to effectively segment customers based on principles impacting CLV, giving retailers a clearer picture who their most valuable customers are.

As many retailers know, it is far more expensive to acquire a new customer than to sell to a current customer. Furthermore, valuable customers tend to be less costly, provide useful feedback, and help create new customers. Thus, it is important to identify these valuable consumers.

Future Predictions and Overall Health

Lastly, a reasonable estimate of customer lifetime value gives a retailer the ability to anticipate its future revenue and predict the long-term impact of acquiring new customers. Overall, CLV provides crucial insight into the health and potential of a company.

Perspectives of Customer Lifetime Value

Historic CLV

Historic CLV is the form of the simplest customer lifetime value, which equals the total value of each transaction for a customer multiplied by the number of transactions. Historic CLV considers all the past transactions of the customers to determine their value, without making any predictions.

Predictive CLV

Predictive CLV estimates the future financial lifetime value for your customers based on their historical transactions and predicted retention, which can significantly augment your company’s growth. Predictive CLV is a useful metric that can help you segment your customers and optimize your business.

Though predictive customer lifetime value is the tell-tale metric for many retailers, calculating it is extremely difficult in a non-contractual setting since purchases are irregular and customer churn is largely undefined.

Factors That Contribute To CLV

Customer lifetime value is not set in stone – CLV is at least somewhat influenced by you as the retailer. It is the outcome of a shopper’s purchase patterns and is directly influenced by the experiences and touchpoints you create as a brand.

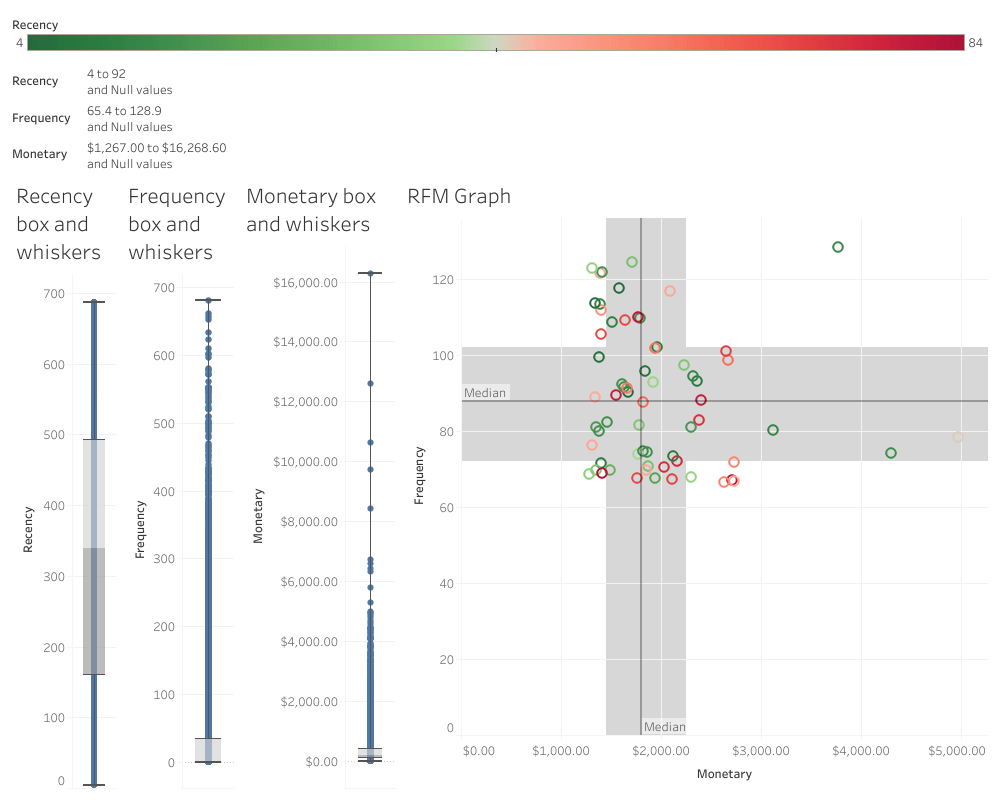

There are a few key factors that contribute directly to CLV, we can break them into three categories: recency, frequency, and monetary (RFM).

What is RFM Analysis, and Why Is It Important for CLV?

RFM analysis is an analytical method that characterizes shoppers by their patterns of behavior. RFM goes hand in hand with CLV, since RFM analysis is an effective way to segment customers into cohorts to track over their lifetime with a brand, thus determining customer lifetime value.

Recency

When was the last time a customer purchased?

Shoppers who have purchased recently are more likely to be active shoppers, and more likely to purchase again. This increases the total amount they spend with your brand and in turn their lifetime value.

Frequency

For our purposes, how much time elapses between a customer’s purchases?

Shoppers with a lower frequency of purchases are more valuable to a brand because they’re likely to become loyal customers and continue to purchase.

Monetary Value

How much money has a shopper spent with your brand overall?

Monetary value is conceptually the same as historic CLV. Shoppers with a greater monetary value have directly contributed more money to your business.

Even in the case of predictive CLV, the amount a customer has spent is a strong indication of her propensity to spend in the future.

Relationship to CLV

By improving any one of the three factors, the lifetime value of a customer increases accordingly.

Product Returns Negatively Impact CLV

Customer lifetime value can be seen as the sum of all the interactions a shopper has with your brand, so naturally, any negative experiences and interactions with shoppers have with your brand lower your average customer lifetime value.

Of course, returns offset sales revenue. So there is an inherent impact on customer lifetime value. But a poor returns experience can also prevent a customer from shopping again, or extend the time between purchases, which results in lower monetary values.

Fortunately, retailers can offset damages to their customer lifetime value by offering shoppers a hassle-free and seamless returns experience.

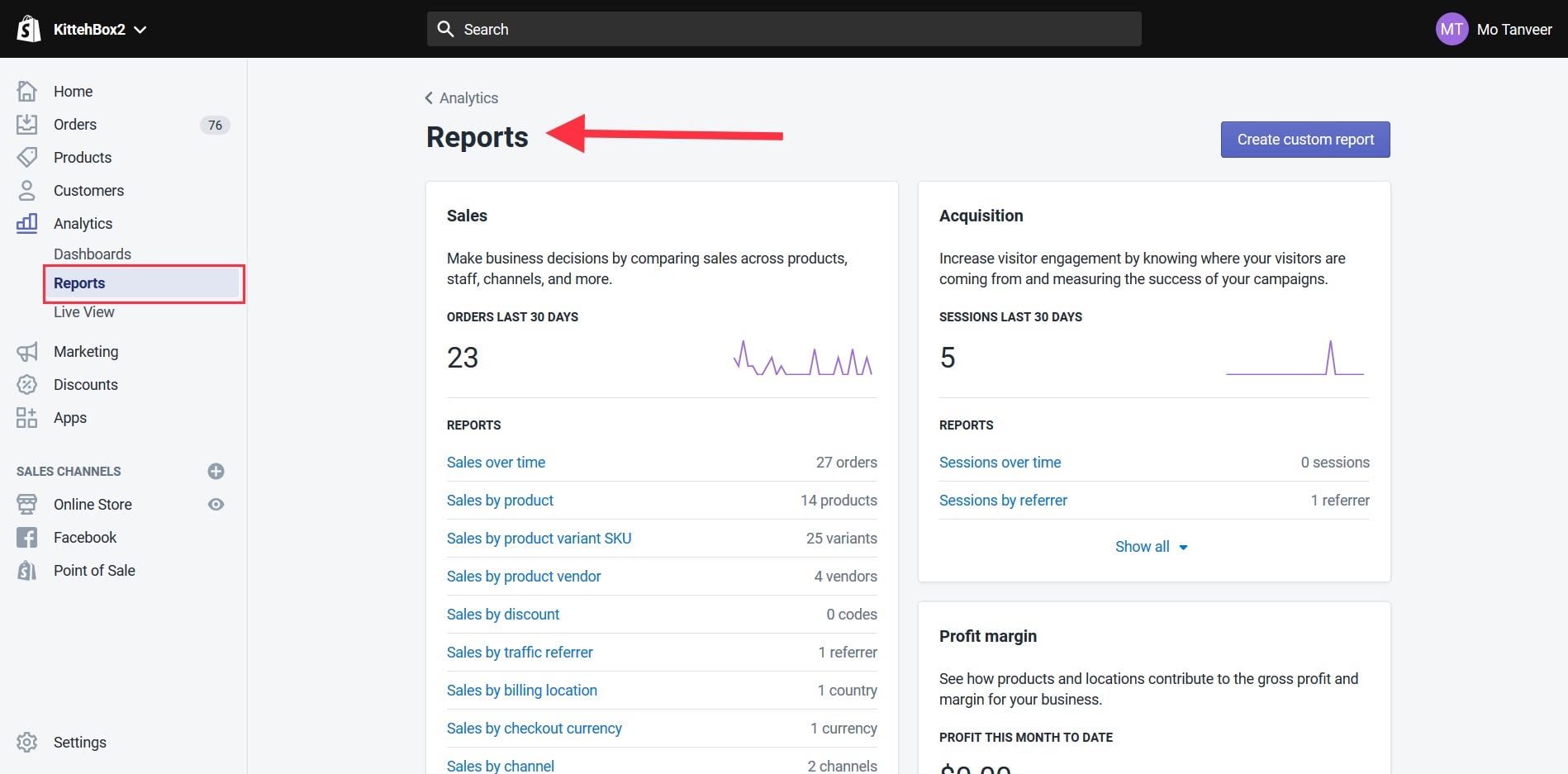

How to Calculate CLV (Free Shopify Calculator)

We built a free Excel-based customer lifetime value calculator that’s easy to use for Shopify brands, here’s how to use it:

Click Here to Download The Shopify CLV Calculator

How to Use The Calculator

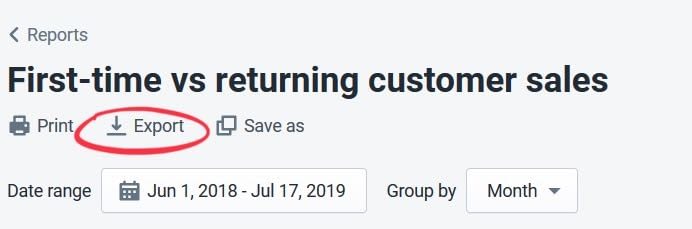

To get started, navigate to the Analytics page on your Shopify site, and access Reports.

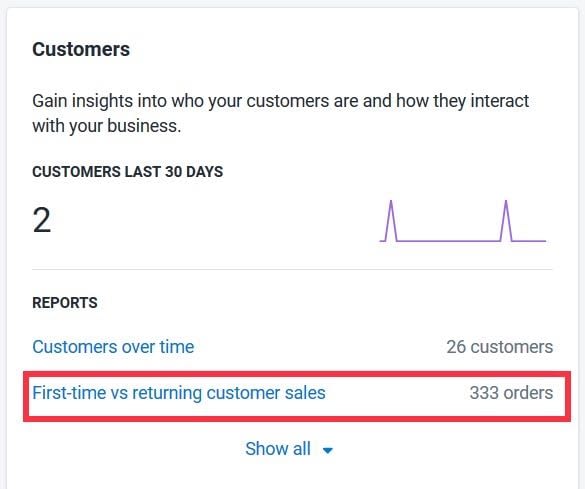

From there, scroll down to the Customer section, and select First-Time vs Returning Customers.

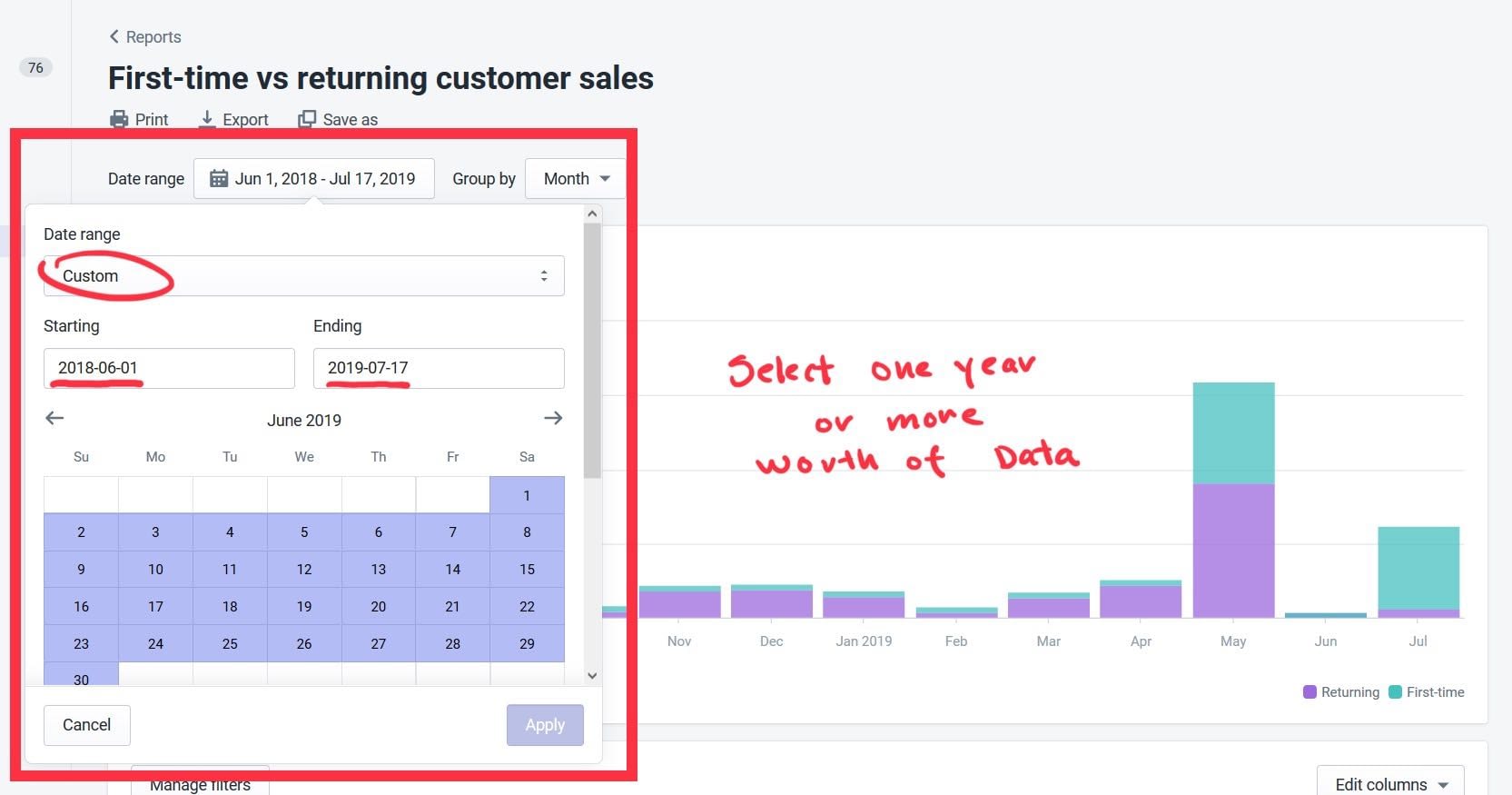

Once in this dashboard, modify your date range to cover at least a year’s worth of data. The more data you can include, the better.

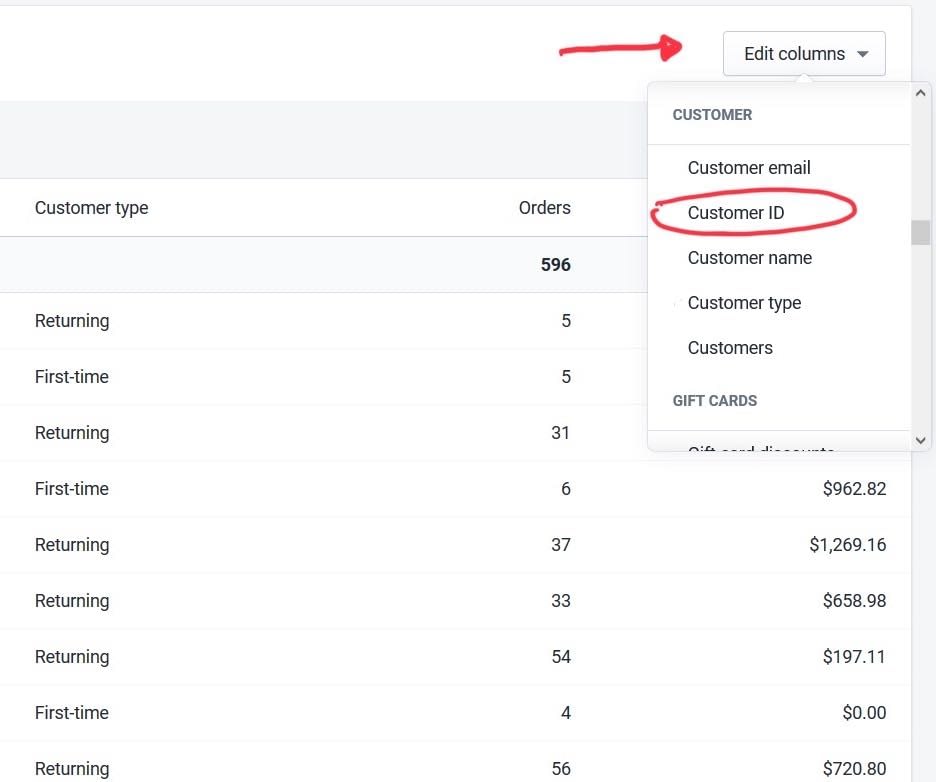

Now click on Edit Columns and select Customer ID.

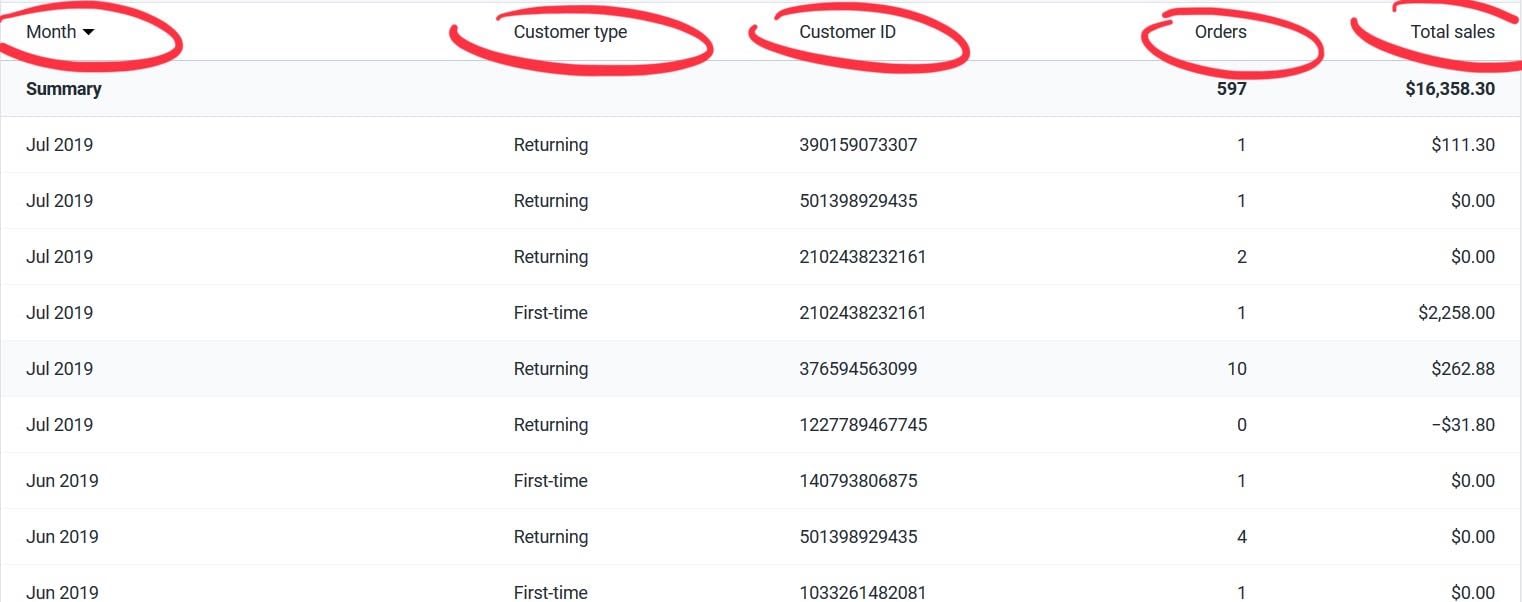

After all this, your columns should look something like this…

Now you can export the data as a CSV!

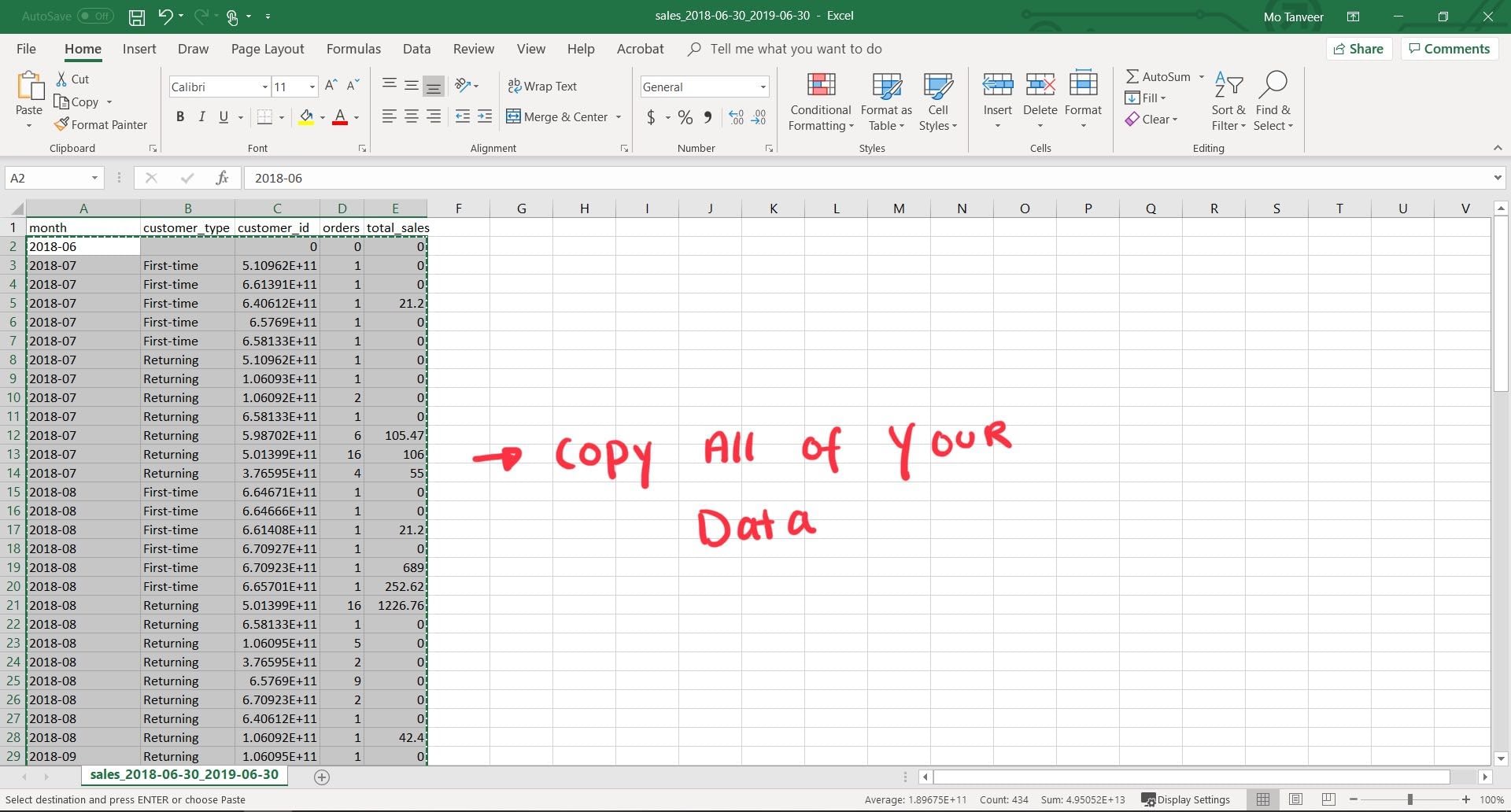

Now, open up the exported CSV in excel and copy all the data, except for the first row (you can delete it if you wish).

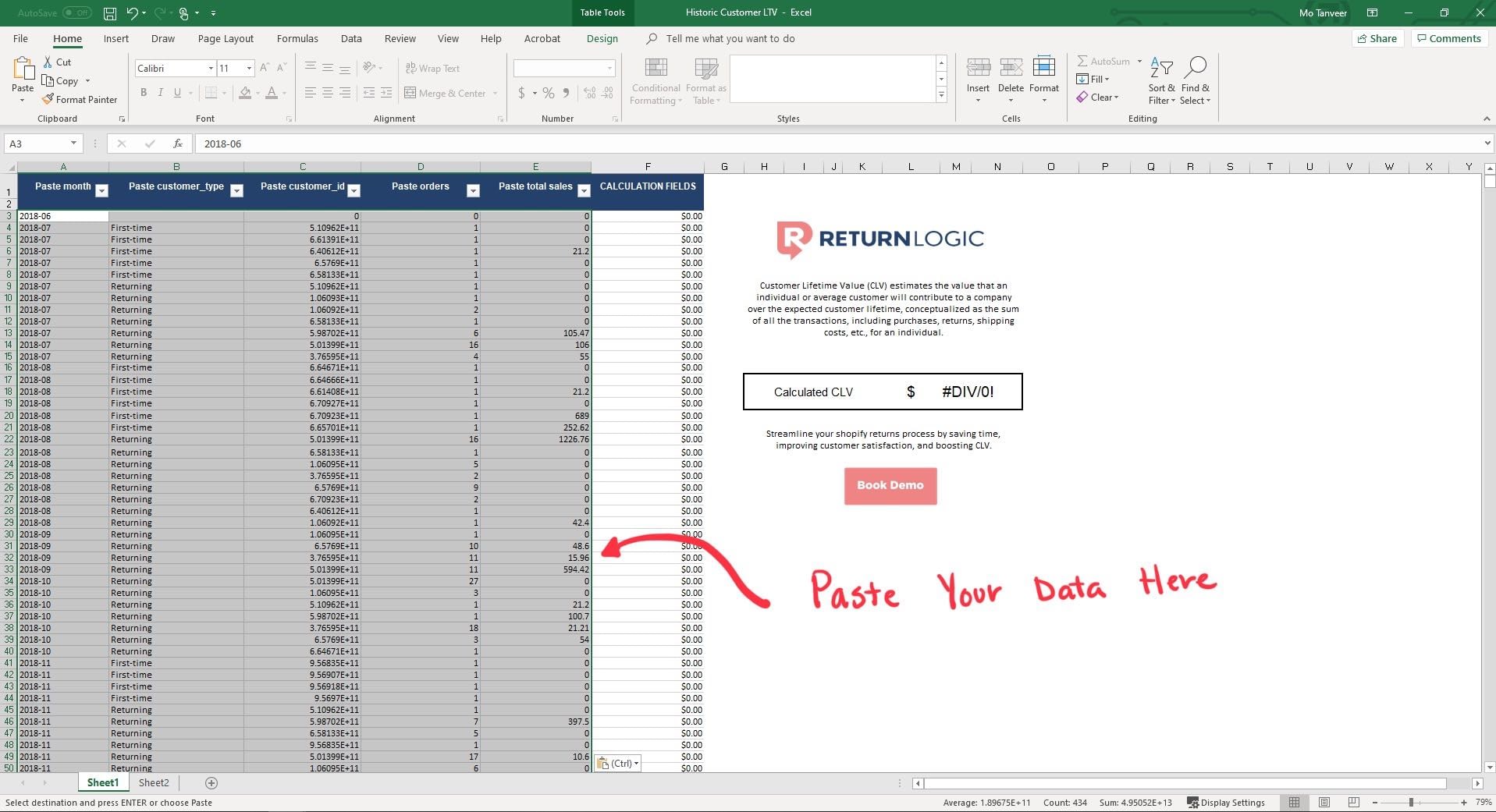

Next, Open the ReturnLogic CLV Calculator in Excel and paste the data you just copied.

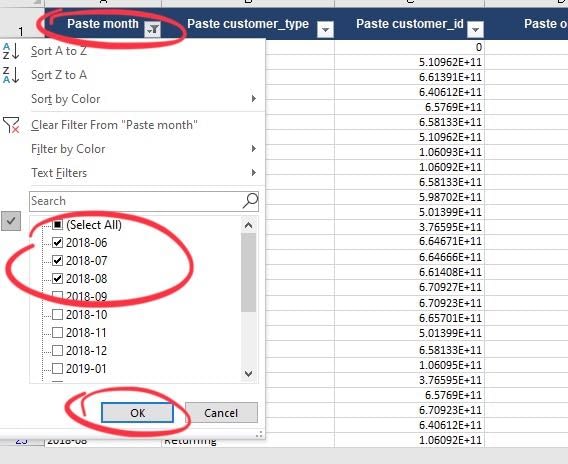

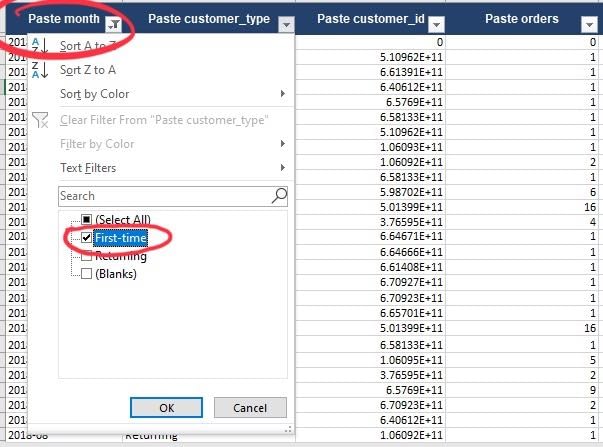

Now, filter the month column, and select a cohort you’d like to track throughout its lifetime with your business. You can select a single month, or several months, just remember that more time a cohort has spent with your brand, the more accurate the data will be.

Next, we need to filter our data to include only First-Time Customers.

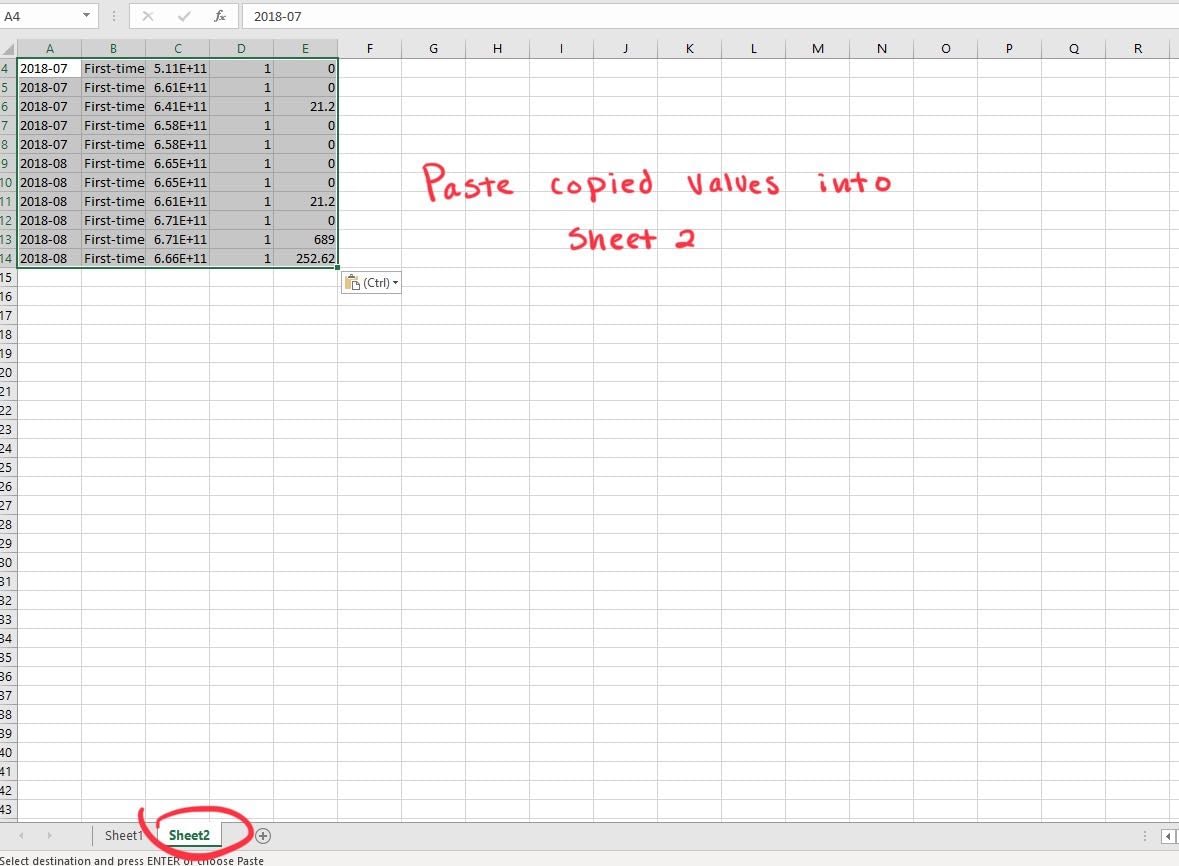

Once our data is filtered, highlight and copy it.

Next paste your data into Sheet 2.

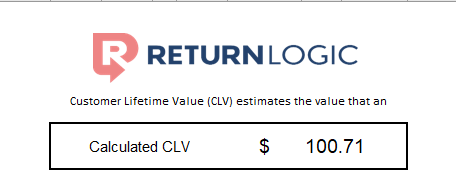

Head back over to Sheet 1, and that’s it you’re done, you’ve successfully calculated the historic CLV for this group of shoppers. This is a practical indicator of your store’s CLV.

In addition, there are a variety of apps that can automatically calculate CLV, such as Polar Analytics.

Ways to Improve CLV

Fundamentally, you can elevate lifetime value by improving customer retention or by increasing the average order value. If shoppers make more purchases, or spend more per purchase, they will be more valuable to your business.

From the perspective of RFM, this largely comes down to purchase frequency – getting customers to make more purchases at a faster rate.

Engagement Campaigns

Whether it be via email or social media, it is vital to maintain a relevant connection with your customers. And segmentation is critical in this process. Grouping consumers by lifetime value, buyer persona, or any other purchasing behavior allows companies to implement more targeted campaigns, which are far more likely to drive traffic.

Studies show that a moderately accurate targeted advertisement can go beyond click behavior and even influence how consumers view their relationship with the brand.

These campaigns are intended to drive interest and engagement, getting shoppers to visit and purchase more often.

Create a Seamless Return Process

By providing a seamless and hassle-free returns experience for your shoppers, you’re more likely to retain them after a return. This means more shoppers will give your brand another shot, improving your purchase frequency and increasing your CLV.

Loyalty Programs

Loyalty programs have been adopted in a wide variety of industries – and for good reason. These programs have proven to be effective not only for growing market share, but also sustaining it.

Loyalty programs signal that a company believes in its product and values its customers. And managed effectively, this strategy keeps customers coming back frequently, and gives retailers the means to identify the most valuable consumers.

Incentives

Either in conjunction with a loyalty program or by itself, special incentives can be a highly effective tactic. Incentives can include discounts, private sales, personalized offers, or other perks. You can determine if your company should offer free shipping by default.

And though incentives often have an associated cost, the lift in lifetime value can well offset the small investment.

Increase Average Order Value

Average order value is a foundational part of CLV and is partially within the influence of the retailer. An increasingly common method of the increasing order value is cross-selling, which is presenting a product complementary to the one in which a customer is already interested.

This concept can be expanded to product bundles, offering multiple products for a lower price than the sum of the individual parts. Such tactics drive immediate sales lift and can create more value for customers if used properly.

Click Here to Download The Calculator

Understanding CLV enables a company to benchmark its financial health and take a more precise approach to customer relationships. It is a vital metric underlying the state of a business, and the ReturnLogic Lifetime Value Calculator makes it simple and easy to determine.